A/P Disbursements

The University may find it appropriate to use the services of individuals who are not University employees. A completed COVA W-9 form must be on file before a payment is processed and is the only form accepted by the State of Virginia. Download the form (PDF).

Services included, but not limited to, are: consulting fees, honoraria, artistic performances, human subjects for research activities, game referees or officials, and physicians or medical centers. Refunds to student or parents of students may or may not require the COVA W-9 form.

Contact System Support @ 568-2941 to determine if this form is on file or if you have any questions.

All requests must be approved in advance by the Associate Controller, Accounting Operations & Disbursements or the AP Manager or the Director of Cash & Investments. Requests will be considered for performance contracts and emergencies only. All other checks will be mailed and vendors should be encouraged to sign up for electronic payments. Checks approved for pickup will be forwarded to the University Business Office to be picked up. Notification will be given by A/P once the check has been processed and is ready for pickup.

Those listings with a voucher number can be referred to Hilary McLaughlin by e-mail at mclaughk@jmu.edu, who will research and reply, or process the ATV correction. Any listings with a journal ID number, or number other than a voucher number, should be referred to iis.finance@jmu.edu.

Write VOID on the check; return it to Cash & Investments @ MSC 5711 immediately with a note explaining the reason for the return (or attach any paperwork the vendor may have sent). Cash & Investments will process the necessary paperwork to return the funds to your account.

Cash & Investments

The W-9 is not required for a SPCC payment, however, it might be required by Procurement.

When JMU pays the monthly SPCC statement, we pay Bank of America directly and already have a valid W-9 on file for them. Procurement would need a W-9 to state enter a vendor into eVA if the vendor has not already enrolled.

Section 4230 of the Financial Procedures Manual provides instructions or contact Cash & Investment for assistance at iis.finance@jmu.edu.

Original ATV files are maintained in Financial Reporting. Contact anyone in Financial Reporting to obtain a copy or email iis.finance@jmu.edu with your request.

If the charge has an associated journal number attached, submit an email to the finance@jmu.edu. Refer to the Finance Office FAQ’s for instructions Finance Office: FAQs - JMU . Remember to maintain your own documentation generated each month. If the charge has an associated voucher number attached, contact Accounts Payable at 540.568.6265.

Use the PeopleSoft nVision reporting feature and select the “B” report, which will show asset and liability lines at the top. If you net the cash account totals (typically A10250/A10255), the result will give you the actual cash balance for that department. If you have any difficulties, please contact Cash & Investments at iis.finance@jmu.edu.

Run the Monthly Exception Report in PeopleSoft:

-

Send an email to iis.finance@jmu.edu for local/agency departments and for E&G/Auxiliary departments

-

Contact Donna Crumpton (540.568.8099, crumptdl@jmu.edu) for Sponsored Programs.

The department providing goods or services will complete a Local Funds Transfer Request Form to charge the “8” department, and a State Funds Transfer Request Form to move the funds to the collecting department. Send both completed forms, along with supporting documentation, to Cash & Investments, MSC 5711. Detailed instructions are available in Understanding Local and State Funds Transfer Forms. (additional information in Section 3045.423 of the Finance Procedures Manual)

Prepare an Accounting Voucher for the charge as follows.

Vendor Name: James Madison University

Vendor Address: JMU EDI Vendor

PeopleSoft Vendor Number: 0000002610

Highlight the Address and Vendor # to alert A/P that this is an EDI payment. Additionally, prepare a credit Deposit Transmittal Form for Electronic Payments for the “8” department for the amount of the charge, using BOA as the Bank Code and BDEP as the Bank Account. Be sure to include in the Description on the DTF the Invoice Number from the Accounting Voucher. Send the Accounting Voucher, backup documentation, and the original & one copy of the DTF to Accounts Payable. When the funds are received, UBO personnel will receipt the DTF copy and return to you for your records.

Equipment Trust Fund (ETF)

Equipment purchased by Equipment Trust Fund (ETF) is not owned by the University but is tied to a leasing agreement with SCHEV (The State Council of Higher Education for VA). For this reason equipment must be held until JMU takes possession of the equipment. (see "Surplus of Equipment purchased by Equipment Trust Fund" table)

Yes, but only if the items are identical. You need a reference number for each piece of equipment and you should list ALL numbers on the requisition in the Header Name. Unlike items require separate requisitions.

Example: 5 computers with the same configuration and 5 printers to create 5 systems.

Prepare the separate requisitions and note on each requisition the component being purchased is part of a system, using the SAME reference number on all requisitions. Reference the main requisition number on all subsequent requisitions so they can be tied together.

Yes. (It must be understood, the printer and/or scanner must remain with the computer as one system.)

You can purchase equipment not on your list under two conditions:

-

The university's entire list will be reviewed to determine if we have a reference number for the item you wish to purchase that is NOT being used by other departments. If one is available, the department that owns the reference number must grant permission to transfer the number to your list. Contact Mariea McNeill for assistance (8/3724).

-

If a reference number does not exist that can be transferred from another department, you must request a new reference number from the Budget Office by emailing your request to etf@jmu.edu. They will contact SCHEV for approval and notify you of the new reference number.

Financial Reporting

All questions regarding student accounts should be directed to the University Business Office at 540.568.6291 or 540.568.6505.

You will see June 30 cash balances near the end of July. Financial Reporting reconciles University financial data to the State's accounting system monthly. At year-end this process cannot be fully completed until near the end of July. Once completed, Financial Reporting "closes the books" for the fiscal year and June 30 cash balances "roll" to the new fiscal year.

Contact Cash & Investments at iis.finance@jmu.edu with your questions.

Submit an email to the iis.finance@jmu.edu mailbox. Please indicate the department number, date of transaction, account number the charge appears under and the voucher # (AP) or journal # (ATV’s and Deposits).

Fixed Assets

Each month a query is run from the PeopleSoft Finance System showing invoices or vouchers that have been entered into the system for payment. Voucher packets are scanned into the OnBase software system daily by Accounts Payable staff. The query is used to review vouchers in more detail in OnBase to determine if the purchase meets all the criteria required to be written up and tagged. All ETF (equipment trust fund) purchases are written up and tagged. Other purchases are reviewed to see if they meet the following criteria:

- The purchase is $5,000.00 or greater

- The purchase is for a functional piece of equipment with a useful life greater than one year

- The purchase is not a component of a building

If these criteria are met, then the purchase is written up and an asset tag is assigned based on how the purchase was funded.

Following assignment of asset tags, the Fixed Assets Coordinator is contacted by the Surplus Property Coordinator to schedule an appointment for decaling equipment. Decaling should be completed within 15-30 days of the tag being issued to the Surplus Property Coordinator.

Each department is required to select an individual to serve as its Fixed Assets Coordinator. This person will not only be the contact for scheduling appointments but also will be in charge of maintaining departmental equipment records and conducting an annual physical inventory. Having a coordinator benefits the department. They are the liaison with Fixed Assets to ensure accurate equipment data.

Completing an EICR form is the only way that equipment changes can be made to your inventory. Please remember to list the property of JMU ID# from the bar code decal. We recommend that the department keep a copy for their records to assist at inventory time and to send the original EICR form to Fixed Assets (after obtaining the necessary signatures) so that the change can be made to your inventory.

All surplus computer equipment is handled by Computer Surplus. Complete an EICR form and email it to fixedassets@jmu.edu for approval. Fixed Assets staff will forward approved EICR forms to Computer Surplus to schedule a pick-up. For detailed instructions please go to the Surplus Equipment webpage and review "Transferring Surplus Computer Equipment to Computer Surplus".

Contact Yvonne Tomlin Tobey at 83748 or tomlinay@jmu.edu or Mariea McNeill at 83724 or mcneilma@jmu.edu to request a current departmental inventory report.

Please see the University's Financial Procedures Manual Section 6005:Asset Control and Management.

Food & Beverage

James Madison University has a contract with Aramark to provide these services to the campus and Aramark maintains the health license for the university.

Yes. See definition of: Official Business Function, Employee Engagement Function, Internal Training Function, Student Academic Function, or Student Programming/Club Function in the Financial Procedures Manual (section 4205 - Expenditures).

No. Purchases from any university account (E&G, Auxiliary, Local, Agency and Grant Funds) are subject to the food and beverage guidelines.

Attach a list (sign in list, invitation list, etc.) or state on the Food and Beverage Certification form that the function was “open to the public” and include an approximate number of attendees.

The meeting must meet one of the five required functions (official business function, employee engagement function, internal training function, student academic function, or student programming/club function) AND approval must be received from catering and dining services. Document the date and person spoken to in catering and dining services that told you they could not meet this request.

Catering and dining services have meals that are within the allowable per diem rate. One option would be to give each person attending an approved Official Business Function, Employee Engagement Function, Internal Training Function, Student Academic Function or Student Programming/Club Function an Aramark Meal Voucher rather than having a catered event. The Meal Voucher, however, must be used at the specified time by the specified individual(s) attending the function immediately following, proceeding or during the meal. When appropriate, departments may contract with Aramark for up to 150% of the per diem rate for an Official Business Function with the written justification for doing so included on the FBCF. In all other situations when the per diem rate is exceeded, the department must use funds from an outside source (i.e. Foundation.) All department events using catering and dining services for business meal functions require completion of the Food and Beverage Certification Form in accordance with the financial procedures manual. (Section 4205 - Expenditures)

Yes! The Meal Vouchers must be reconciled monthly! You should use the Meal Voucher Usage Log available on the Finance Procedures Manual - Forms Index. This form serves as a substitute Food and Beverage Certification Form.

Students, Recruits, Interviewees, and Guest Speakers, as well as attendees at Official Business Functions, Internal Training Functions, Student Academic Functions, Student Programming/Club Functions or Employee Engagement Functions in accordance with Financial Procedures Manual (section 4205 - Expenditures) .

Meal tickets are not to be used as rewards or recognitions for employees (including student employees) or for incentives.

No. Food and beverages are not to be served at regularly scheduled (monthly, weekly, bi-weekly) departmental or divisional staff meetings.

Retreats should be held at properties owned or leased by JMU. Retreats held off campus require advance approval by the approving authority, the appropriate VP, as well as the Asst VP for Finance. A completed Departmental Off Campus Authorization Form is required prior to setting up retreats. The Hotel Madison and Shenandoah Valley Conference Center is not a property owned or leased by JMU.

If the purpose of the lunch meets one of the specific functions described in the Procedures the director may do so. (Section 4205 - Expenditures)

No. Food and beverage may be provided for the following specific functions: Official Business Function, Employee Engagement Function, Internal Training Function, Student Academic Function, or Student Programming/Club Function.

Yes. These types of food and beverages are being considered as refreshments/snacks and not a complete breakfast.

Yes! Meal Vouchers must be reconciled monthly. We recommend use of the Meal Vouchers Monthly Usage Log to track meal vouchers as they are used for an approved function. If you choose not to use the Meal Voucher Monthly Usage Log, you will need to complete the Food and Beverage Certification Form and attach it to your back-up documentation. The Usage Log can be found in the "Forms Index" of the Financial Procedures Manual.

You may choose to use the Duke Card Monthly Usage Log to track expenditures in place of the FBCF. If you do not use the Duke Card Monthly Usage Log, you will need to attach a completed FBCF to your back-up documentation. Cardholders may sign their own Duke Card Log or FBCF; supervisors are not required to approve these forms. The Usage Log can be found in the "Forms Index" of the Financial Procedures Manual. Departmental Duke Cards are NOT to be used at off campus merchant locations.

Purchases must be considered essential to the operation and in support of the university’s mission. The following list contains examples of expenditures considered to be improper use of State funds. This applies not only to the Departmental Duke Card, but also any state-funded expenditure, and is intended to provide general guidance in judging the appropriate use of State funds. Improper expenditures would include:

-

Books for employee classes

-

Food not related to an approved employee recognition event

-

Holiday decorations or parties

-

Charitable contributions

-

Gifts & gift certificates, flowers, cards, gift-wrap

-

Snacks/refreshments or meals unless they meet requirements in Food & Beverages Procedures. Official business meals at off-campus locations may not be paid for with a departmental Duke Card.

-

Non-business related newspapers or magazine subscriptions

-

Clothing or repairs to clothing damaged in the workplace

-

Employee personal expenses

Hotel Madison

No, University Procurement and Finance staff met with Hotel Madison representatives to discuss contractual terms and payment processing. If a meeting is to be scheduled, contact your Procurement representative as well as the Finance team (Tish Leeth and Tina Wells) to determine if anyone from these offices should also attend the meeting. Remember, departments are not authorized to negotiate contractual or payment terms. Non-contracted, group dining events in the Montpelier Restaurant or other dining facilities located within the Hotel Madison may not be direct billed. Official business meals are reimbursable per the JMU Financial Procedures Manual subsection 4215.352.

The W9 has already been received and processed; the vendor number is #90985.

Accounts Payable has already provided this. Please review all invoices to ensure state or local sales tax is not being charged on direct billed catering of meals. The university is exempt from state and local sales tax paid on meals paid for directly by the university. Meals paid for by individuals and then reimbursed by the university are not exempt from sales tax.

The Finance Office completed the process once for the entire university.

Hotel Madison is the University's preferred partner. There is no requirement to use the Hotel Madison for lodging. Securing the rate closest to per diem while considering the related needs of the traveler remain the primary obligations when using state funds.

You may hold the rooms with your SPCC and the Hotel Madison has agreed to Direct Bill for the entire lodging bill upon checkout. There should be no charge to the SPCC. It is the JMU staff member’s responsibility to communicate to all guests with lodging to be direct billed to JMU that they may not request meals and incidentals to be placed on the direct bill portfolio. The Hotel Madison will establish a separate portfolio with the guest’s personal billing information for any charges other than room, taxes and parking per the guest’s request. JMU employees/departments are not to request special arrangements for direct billing of guest meals – these must be paid for separately and not direct billed with lodging/guest parking.

A JMU Procurement Services team member will sign general, non-revenue contracts. The Assistant Vice President for Finance will sign revenue-generating contracts (such as conferences with registration fees). JMU departmental employees cannot execute/sign these contracts per university policy 4100.

The Hotel Madison & Shenandoah Valley Conference Center may require one night's deposit and will Direct Bill for the remaining balance due following the contracted events. Accounts Payable is to receive all invoices. Non-contracted events are payable upon receipt of services and may be submitted for reimbursement as appropriate.

Retreats should be held at properties owned or leased by JMU. Retreats held off campus require advance approval by the approving authority, the appropriate VP, as well as the Asst. VP for Finance. The Hotel Madison & Shenandoah Valley Conference Center is an off campus venue. A completed Departmental Off Campus Authorization Form is required prior to setting up off campus retreats.

All expenditures from University funds must be necessary, reasonable, and directly related to the goals and mission of the University. All persons authorizing expenditures should be mindful that such expenditures are subject to scrutiny by State authorities, sponsors, auditors, and other interested parties: Finance Procedures Manual: Procedure 4205.

The expectation is that Off Campus Authorization Forms submitted are due to insufficient space availability at properties managed by the university and taking in to consideration the additional cost to the university.

University policy 4501: University Business Activity requires submission of the business activity synopsis (BAS) and cost benefit analysis (CBA) for approval when registration fees or other payments are to be collected.

These documents are submitted to the Director of Cash and Investments for review and then the Assistant Vice President for Finance will approve as appropriate. The JMU Financial Procedures Manual section 4100 on Deposits speaks to departmental responsibilities for accepting payments, specifically subsection 4105.210.

Departments are not authorized to accept payments until they have received a written approval of the BAS and CBA.

The current per diem rules apply at the Hotel Madison & Shenandoah Valley Conference Center just as they would for any venue. This includes the requirement to opt for self-parking rather than valet parking.

Please refer to the JMU FPM 4215 for additional information related to travel procedures, specific to travel: 4215.340 and 4215.313 for conferences.

- No, advise visitors to James Madison University to park on campus.

- Reimbursement cannot be made for charges specifically for parking in Hotel Madison & Shenandoah Valley Conference Center parking spaces by campus visitors when not a patron of that facility.

- Patrons of the Hotel Madison & Shenandoah Valley Conference Center are to use designated Hotel Madison parking spaces.

- University campus visitors are to use university campus parking spaces.

- General parking lots are available during game days and departments are to continue coordinating with Parking Services for guests requiring parking during the week.

Yes, if asked for a lodging reference by an external party, you are to refer to the Hotel Madison as the university’s preferred partner.

Yes, if JMU Event Management is unable to assist when asked for a conference center reference, they will refer to the Shenandoah Valley Conference Center as the university’s preferred partner.

No, JMU employees are not allowed to collect points for personal use based on university business.

The preferred method to secure a reservation with Hotel Madison is directly through the Hotel Madison website. Please follow these easy instructions to complete your reservation, How to enter a direct bill for Hotel Madison.

You may also email them at jmu@hotelmadison.com. Requests sent to this email address MUST come from a valid jmu.edu email address. You will need to include the check-in and check-out date, first and last name of your guest, email, and phone number of your guest, as well as the department being billed and contact person.

There is no longer folio approval with either reservation method. Keep this in mind, if you are going through the email process.

All bills will be sent directly to Accounts Payable.

Sales & Use Tax Update: Prepared Meals

View a PDF version of the Virginia Department of Taxation's Tax Bulletin 16-3.

Effective April 22, 2016, The Department of Taxation revised its policy regarding the application of the Retail Sales and Use Tax to catering and other services related to purchases of food and meals by State & Local governmental entities.

According to the new policy, state and local governmental entities may now use their respective exemption certificate (Form ST-12) to purchase prepared foods, catering and related services provided in connection with the sale of food exempt of the sales and use tax if the entity meets the following criteria.

- The applicable prepared foods, catering and/or related service furthers a function, mission, service or purpose of the entity.

- The charge for the food, meals or catering is billed to and paid for by the entity rather than using cash or an individual’s account.

- The entity determines to whom, when and how the meals or food is served and consumed.

Catered events, including those catered by Aramark are exempt from sales and use taxes as long as the event supports the mission of the University as defined in the CAPP/Cardinal topic 20310 (PDF).

University purchases must be considered essential to the operation of the University and in support of the University’s mission. Catered events of this type can be paid using State Funds and are tax exempt under this rule.

University-Sponsored event expenses that do not support the University mission, including retirement parties, employee going away parties, and birthday or holiday celebrations do not meet the test for essential to the operation of the University. Catered events of this type cannot be paid for using State Funds and are not tax exempt under this rule.

Meals consumed by individuals while on travel status at restaurants are not part of this tax exclusion. Employees traveling to in-state conferences or purchasing and paying for a business meal at the restaurant customarily seek reimbursement of the meal at a later time. Because the meal is not billed directly to the University and the University does not determine to whom, when and how the meal will be consumed, the University employee will be subject to sales and use tax on the meal purchase.

Business Meals are part of the University’s mission therefore a business meal, including business meals with job candidates would qualify for the exemption. Note: the exemption will apply only if the meal is direct billed or paid by the Small Purchase Charge Card (SPCC) with the proper exception in place in advance and university approved direct bill arrangements. Due to the requirement to confirm per diem compliance, approval of direct bill and SPCC payment exceptions for Business Meals are rare. If the meal is paid by personal credit card; then the meal is not exempt from sales and use tax. For BUSINESS MEALS, the Sales and Use Tax paid for by using a personal credit card WILL BE a reimbursable expense.

Prepared Meals Purchased for later consumption qualify for the tax exclusion. Purchases made at grocery stores for prepared food items to be consumed at the University charged to the SPCC or direct billed to the University are tax exempt under this bulletin. If the meal purchased at the grocery store is paid for by personal credit card; then the meal is not exempt from sales and use tax. For PURCHASED MEALS, the Sales and Use Tax paid for by using a personal credit card WILL BE a reimbursable expense. Meals paid for via direct bill or SPCC, and determined not to be within per diem, will be subject to repayment from non-state funds.

JMU Conference Services will work with its individual customers to identify if they qualify for this tax exemption. The customer hosting the catered event must qualify for their exemption based on its legal entity status/mission/method of payment, etc. The customer must be either a state and local governmental entity, a nonprofit organization, or a nonprofit church to qualify under this exemption. If the customer is not a qualifying entity, then its catered event is subject to sales and use tax, even if the event is held at the College.

Student organizations should not use the University’s tax ID number to conduct business. Student organizations’ purchases are not exempt under the University’s umbrella. Student organizations must obtain their own exemption certificates to be eligible.

For a purchase to be exempt from sales and use taxes, departments and other business units are encouraged to use their SPCC or Direct Bill the purchase. The purchase is not exempt from sales and use taxes when using personal credit cards, which means that sales and use taxes charged may not be reimbursable. Remember use of SPCC/Direct bill require prior approval.

Once you have determined that your meal activity is exempt from sales and use taxes, you must provide the vendor with the Commonwealth of Virginia Sales and Use Tax Certificate of Exemption (Form ST-12). You may obtain the form from the FPM Forms Index.

The SPCC can be used for food purchases under $250 and consumed on campus without any prior approval that meets one of the four food and beverage certificate requirements. For food purchases over $250 or consumed off campus, the SPCC cardholder can submit an exception request to make that purchase by SPCC. Direct billing agreements should be limited only to those instances where SPCC is not an option and must be approved in advance (and in writing) by working with Accounts Payable. Hotel Madison should not direct bill restaurant meals without prior advance documented approval by the proper authorization (departments are not authorized to provide this). All required documentation regarding the sales tax exemption for state and local taxes related to food and catering has already been provided to Hotel Madison and Shenandoah Valley Conference Center for all James Madison University events.

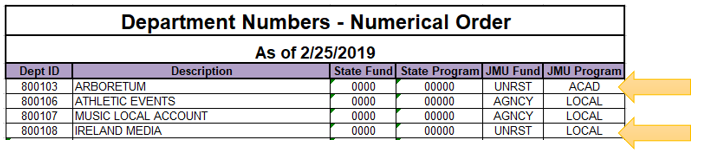

This exemption is not applicable to Agency Funds. Since both Local and Agency Fund department IDs start with an eight, you will need to know or confirm which type of department ID you have. Note, due to GASB changes, some codification revisions were made in Fiscal Year 2020 so please confirm the status of your DepartmentID. This information is available in the JMU Financial Procedures Manual (FPM) subsection: 2010.200 Department Listing. See the example below, where the department numbers with the yellow arrows would be exempt and the other two are not.

Any sales tax paid on meals purchased during non-travel activities that meets #1 (mission) and #3 (college determination) requirements and could have been paid for by SPCC or direct billing but a personal credit card was used instead, may not be reimbursable.

Sales tax paid for meal purchases during travel status are reimbursable.

Small Purchase Charge Card

Transaction limits will be set at $10,000 on all cards. The monthly limit can be anywhere between $10,000 and $100,000 a month. If at any time your monthly limit needs to be adjusted, complete the Monthly Credit Limit Increase form in the SPCC PeopleSoft Finance Electronic Forms and it will be changed accordingly.

Yes, you can pay for airline tickets for you or anyone in your department. Please remember no airline tickets can be purchased more than 180 days before travel.

Yes, you can pay for conference registration fees for you or anyone in your department. Please remember no conference registration fees can be purchased more than 180 days before travel. If you feel you need an exception please email Tina Wells (wells2tm@jmu.edu) and attach a word document with the following:

- Name of conference, don't use initials, spell it out

- Exact date/dates

- Place of the conference with full address

- Legitimate reason to pay outside the 180 day window

- Cost of the registration

- Cancellation policy

- Substitution policy

- Web link of Conference

- Who is attending

When you purchase conference registration fees keep a copy of your conference registration with your monthly SPCC reconciliation paperwork.

No, hotels and rental cars can NOT be paid for on the small purchase charge card for faculty/staff travel. You can pay for these items using a travel card or personal funds and submit for reimbursement after you travel. Exceptions can be made on a case by case basis for team/student travel by a SPCC Program Administrator. You must complete the Exception Request form in the SPCC PeopleSoft Finance Electronic Forms. If approval is given, only room rate and taxes may be paid on the SPCC - any other charges must be paid from personal funds.

Yes, each small purchase charge card must be reconciled in WORKS monthly beginning January 2022. All charges are required to be moved out of the default account code 130900 and an eVA exclusion or PCO/PO number must be given for each purchase. To reconcile in WORKS you must have access which is given when a new cardholder/reconciler or approver is identified. You must complete the Manage SPCC Reconcilers form in the SPCC PeopleSoft Finance Electronic Forms to add reconcilers (including cardholder) to your card. In order to add additional Department ID’s you must complete the Manage Department ID’s form in the SPCC PeopleSoft Finance Electronic Forms.

Transactions in the Bank of America WORKS system are available to be reconciled as soon as the transaction posts to your card. The billing cycle runs from approximately the 16th of the month to the 16th of the following month. All transactions for a billing cycle must be reconciled and approved in Bank of America WORKS by the 5th of the following month. Example: transactions for the August 15th billing period must be reconciled and approved by September 5th.

Yes. This should be done during open reconciliation in Works.

All Small Purchase Charge Cards have the restaurant block lifted for local pickup or delivery purchases up to $250. Anytime you make a food purchase you must complete the Food and Beverage Certificate Form (FBCF), and have an itemized invoice/receipt to upload with the transaction in Bank of America WORKS. All food purchases in Virginia are tax exempt. This exception is NOT for dine-in service. You may tip up to 20% of the food amount (before delivery fees).

No.

Yes, as many people as needed in a department may each have a small purchase charge card.

No, the only exception to this is while in eVA if the cardholder has been associated with that person. No other time is it allowed. NEVER use someone else’s card on the phone, on the Internet or in person.

In a locked secure location.

No. Call the vendor or provide this information in person. Do not mail/fax/email or scan a full account number, CVV or expiration date.

The W-9 is not required for a SPCC payment, however, it might be required by Procurement.

When JMU pays the monthly SPCC statement, we are paying Bank of America directly and already have a valid W-9 on file for them. On the front-end of your SPCC purchase, Procurement would need a W-9 if the vendor is not already enrolled in eVA so that they can do a state-entry for that vendor.

Yes. When reconciling the SPCC charges in PeopleSoft Finance you can reference either a PCO/PO, or eVA exclusion.

Yes. When reconciling the SPCC charges in PeopleSoft Finance you can reference either a PCO/PO, or eVA exclusion.

Yes. A cardholder has the ability to charge any department within the BOA Works system.

Yes. If a vendor needs a copy of JMU's tax exempt certificate, you can obtain one from the FPM Forms Index.

Yes. As long as the vendor states they will be charging a convenience or usage fee, then you may use the SPCC to pay the charge. A convenience fee is a flat (set) fee. If a vendor changes a percentage fee, this is a surcharge. Please refer to surcharging FAQs and merchant surcharging.

Only if you have received permission in advance. Any order totaling more than $10,000 needs to be approved through Procurement first. You must complete the Single Transaction Increase form in the SPCC PeopleSoft Finance Electronic Forms in order to receive approval to pay an invoice totaling over $10,000 on your SPCC. We will verify with Procurement the charge is ok to pay before raising the limit on the SPCC to make the purchase. If you do not receive permission first, that is considered a split purchase and is against Procurement policy. When requesting an exception to make a payment over $10,000 using the SPCC, be sure to indicate whether or not the purchase documents/invoice have been communicated to Accounts Payable yet so we can be sure to avoid duplicate payment to vendors!

Surplus Property

Surplus property is university owned personal property (furniture, equipment, supplies, etc.) that is determined to be excess unwanted, or can no longer be utilized by a department. All university property considered as surplus (excluding transfers between departments) must be processed by our surplus property staff according to university and state policies and procedures.

Redistribution of surplus property is our main goal. First priority is meeting the needs of university departments by offering usable surplus items as available. Secondly, we market and transfer surplus property to other state agencies thus prolonging the economic benefit to the Commonwealth. Assets deemed surplus by a department are kept at the Surplus warehouse located at 1070 Virginia Ave. Following a reasonable time period, other approved methods of disposal are pursued.

Visit Surplus Equipment and follow procedures for "Obtaining Items from Surplus Property".

Visit Surplus Equipment and follow procedures for "Transferring All Surplus Items other than Computer Equipment to Surplus Property". An EICR form must be completed for all items to be transferred to Surplus Property.

Please complete an EICR Form for all equipment, furniture, supplies, etc. that is transferred to Surplus Property, another department, or a different building, and all disposal requests.

Note: Please record all JMU ID numbers accordingly

Send an email with your request for computer equipment to computersurplus@jmu.edu.

Surplus computer equipment is picked up and processed by Computer Surplus and NOT Surplus Property. Visit Surplus Equipment and follow procedures for "Transferring Surplus Computer Equipment to Computer Surplus".

NOTE: If the computer equipment has an Equipment Trust Fund (ETF) JMU barcode decal, you must verify that ownership has passed to the University and it can be surplused. See "Surplus of Equipment purchased by Equipment Trust Fund".

Travel

You have four options to purchase air or rail tickets.

- Use one of JMU's contracted Travel Management Agencies, which requires the traveler to secure the tickets with a credit card number.

- You may use your Travel Card.

- You may use your department's Small Purchase Charge Card.

- You may use a personal credit card.

No, lodging per diem guideline amounts exclude local taxes and surcharges. These charges are reimbursable. The amount of tax billed should be pro-rated for reimbursement according to guidelines, not the total amount paid if it is more than the guideline amount.

Some examples are bellhop tips, personal telephone calls, laundry expenses, snacks and travel between lodging & places where meals are taken and other expenses.

A business meal is a meal taken with a non-university employee that involves official business discussions. The employee requesting reimbursement must complete the Business Meal form within Chrome River and submit it with an original, itemized receipt. The traveler's Approving Authority may with sufficient justification, authorize actual meal reimbursement up to 150% of the applicable per diem guideline amount.

The reimbursement rate for mileage is available in an online table (as part of the Financial Procedures Manual). The University usually considers a personal automobile cost beneficial for occasional travel planned for distances up to an average of 280 miles per day and reimbursed at the higher rate. Campus Visitors, such as consultants and speakers, University Board of Visitors members and certain prospective employees, students, and anyone who is not a state employee, may be reimbursed within Chrome River for all personal vehicle mileage at the maximum mileage reimbursement rate.

The Commonwealth uses the U.S. General Services Administration (GSA) rates for Lodging and M&IE Expenses; these rates are automatically loaded into Chrome River. The traveler must enter in Chrome River the travel destination in order to obtain the correct per diem rate. The traveler may want to search the per diem criteria outside of Chrome River by going to the GSA page for Per Diem rates.

The Commonwealth uses the U.S. General Services Administration (GSA) rates for Lodging and M&IE Expenses; these rates are automatically loaded into Chrome River. The traveler must enter in Chrome River the travel destination in order to obtain the correct per diem rate. The traveler may want to search the per diem criteria outside of Chrome River by going to the GSA page for Per Diem rates and clicking "Visit the State Dept Site".

Alaska and Hawaii are considered to be International travel and can be searched outside of Chrome River by going to the GSA page for Per Diem rates and clicking on Hawaii or Alaska.

On a travel departure or return day, 75% of the M&IE rate is reimbursed. The calculation for this reduction is in Chrome River.

For trips involving multiple travel destinations, base the reduction rate in effect for where the night was spent as follows:

Departure Day - Where you spend the night.

Return Day - Where you spent the night before returning to home base.

When meals are provided at no cost in conjunction with the travel events, the applicable M&IE rate shall be reduced in Chrome River by the selection of the applicable meal. For example, if lunch was provided at no cost, a deduction for lunch should be selected in Chrome River.

However, when meals are provided at no cost in conjunction with travel events on a travel departure or return day, the full M&IE rate is reduced by the full amount of the appropriate meal/meals. For example, if lunch was provided at no cost on a travel departure or return day, the deduction of Travel Day as well as lunch should be selected in Chrome River.

When meals are included with registration or lodging expense as part of a package, the number and type of meals (breakfast, lunch, dinner) must be recorded on the Chrome River Expense Report.

A hardcopy of the final page from the Internet site showing a breakdown charge of each day, total cost & confirmed service.

NOTE: This document must state that it is a receipt or be clear that payment was made. Please check for an option to “print a receipt”.

Airline confirmation (ticket stub, boarding pass or receipt) documenting the type of ticket purchased (e.g. coach, economy, business, etc.)

Employees are able to login to MyMadison and access the Employee tab to see reimbursements for that year at a single glance in summary.

If you receive the message “You do not have any reimbursements at this time,” then you either have not submitted any Chrome River expense reports for reimbursement, submitted reports are currently being processed, or the reimbursement doesn’t fall within this calendar year.

For a printed record of reimbursements, click on the Excel download icon in the menu bar. You can choose to open or save the document. It will download all of your available reimbursements, even if they are not displayed on the first screen in MyMadison Employee tab. Print from Excel.

If you have more than 15 reimbursements, you can choose to “View All” by selecting that link from the menu bar.

First check to see if the reimbursement expense report has been entered and approved in Chrome River (entered by yourself or a delegate in your department). If it has been approved and you are still not seeing the reimbursement come through, please contact acctspayable@jmu.edu.

For information on your reimbursement history or for any additional questions you may have, please contact Accounts Payable at acctspayable@jmu.edu or Cash & Investments at iis.finance@jmu.edu.