Our office has begun providing Preliminary Financial Aid Offers to accepted prospective students with official 2026-27 FAFSA's on file. This information can be accessed through a student's "Applicant Center" in their MyMadison account.

How to View a Preliminary Aid Offer

- Log into MyMadison

- Click on the “Applicant” tab

- Select the “Applicant Center”

- Click on the “View Preliminary Award Notice" link. The PDF document will open in another window.

Keep In Mind

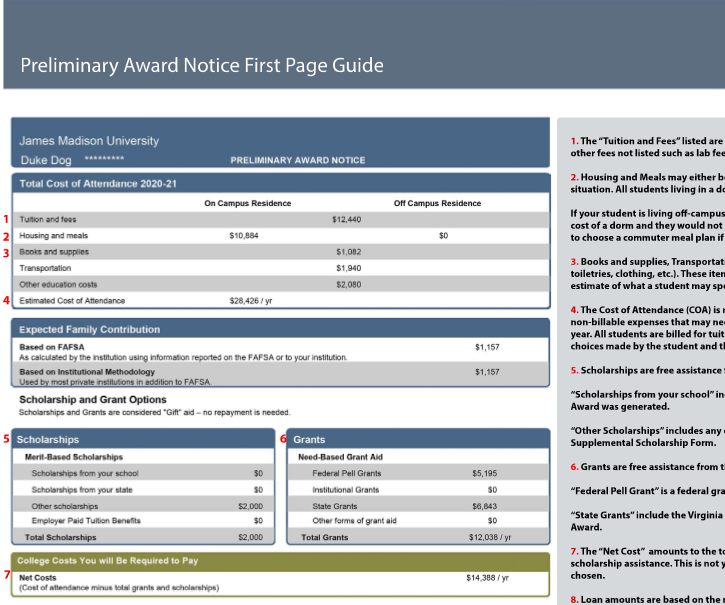

- The offers are an estimate based on the Cost of Attendance from the 2025-2026 academic year as the 2026-2027 year's rates have not been established at this time.

- The information shown is a good indication of what a student may expect to pay while attending JMU for one year.

When comparing the cost of JMU and other schools, we recommend you focus on the net costs versus any particular scholarship offers. For example, it's possible in some situations that the net cost of JMU without a scholarship offer could be less expensive than the net cost of another school with a scholarship offer.

Aid Offer

Prospective students that were accepted for Fall 2026 should be able to access their Preliminary Financial Aid Offers through the "Applicant Center" in their MyMadison account if they have an official 2026-27 FAFSA on file with JMU.

Preliminary Aid Offers should include any scholarship offers made by departments that our office is notified of.

Preliminary Aid Offers are viewable within a student’s MyMadison account within the Applicant Center.

There may be various reasons why an aid offer is not showing in a student’s MyMadison. These can include:

- A FAFSA was not submitted to JMU - If a student wishes to receive financial aid, they will need to complete a FAFSA through Studentaid.gov.

- A student’s social security number in the JMU system is either incorrect or not in the JMU system at all. If a student did not include their social security number on their JMU application they should be able to update that information in their MyMadison account. But if the social is incorrect the student should contact our office to have that information updated so we can receive a student’s FAFSA.

- We also suggest using Firefox or Chrome on a computer and not a mobile device such as a phone or tablet as there are sometimes issues viewing a Preliminary Aid Offer this way.

FAFSA

A FAFSA should be completed through Studentaid.gov.

Yes, a FAFSA can be completed throughout the academic year. However, we do suggest that a student complete their FAFSA as soon as they can since the FAFSA opened October 1st.

Scholarships

JMU houses our scholarship applications through the Madison Scholarships Hub. There is a general application that prospective students can complete here. The Madison Scholarship Hub can be accessed through a student’s MyMadison account.

A department offering a scholarship should be in direct contact with the awarded student through the email provided on the student’s JMU Admissions application. This email notification would come from scholarships@jmu.edu. In most situations, a student would be notified of the scholarship offer prior to our office being notified. Any scholarships offered at the time the Preliminary Aid Offer is generated should be included on a student’s aid offer.

Unfortunately, if a scholarship is not shown on a students aid offer JMU was unable to offer a scholarship.

Grants

JMU can potentially offer a student a Federal Pell Grant and/or a State Grant. Both are need based programs and require a FAFSA to determine eligibility.

Grant eligibility is determined by a students calculated Student Aid Index (SAI) from their FAFSA and their Need. Financial Aid Need is calculated by taking the student’s Cost of Attendance minus their SAI.

Loans

By completing the FAFSA a student has potential eligibility for a Federal Subsidized and/or Unsubsidized Loan. The type of loan is determined by a student’s financial need using the FAFSA. The amount offered is also dependent on a student’s academic level shown below.

Freshman: $5,500

Sophomore: $6,500

Junior/Senior: $7,500

A student can only be offered an Additional Unsubsidized Loan if their parents are denied for a Parent PLUS Loan based on the credit check done within the PLUS loan application and choose not to pursue an endorser. Freshman and Sophomores can be offered up to $4,000 per academic year, while Juniors and Seniors can be offered up to $5,000.

No, only parents of the student are able to apply for a Parent PLUS Loan to help pay for a student’s education. Though a biological or adoptive parent does not necessarily need to be included on a FAFSA to be eligible to apply. We suggest that parents also take time to review the changes that are being implemented on July 1st, 2026 to this program by viewing this video and visiting the Parent PLUS Changes webpage.

Other loan options include a private educational loan through a third-party lender such as a bank or credit union. It is up to the discretion of the student to whom they choose to complete an application with and borrow from. Our office will work with any lender a student should choose to have the money applied to their account. Visit our Private/Alternative Loan webpage for more information.

Appeals

Students can only appeal for extenuating circumstances not reflected on their FAFSA through a process called Professional Judgment. For more information regarding appealable situations and the process visit our Professional Judgment page.

Unfortunately, no. JMU does not offer any scholarships through an appeal process.

JMU does not match scholarships offered by other universities. We unfortunately do not have the endowment funding available to match.

A student with an extenuating circumstance not reflected on their FAFSA should submit a Professional Judgment request to our office. Please visit our Professional Judgment page for appealable situations and to understand the process.

What is Next?

Students are unable to accept a Preliminary Aid Offer. Once a student makes the decision to come to JMU based on their Preliminary Aid Offer, our office will work to generate Official Aid Offers in late June. This is when a student can accept their aid for the upcoming academic year through their MyMadison account.

Yes, students can complete job applications through the JMU Jobs section. Please understand that Federal Work Study employment is not guaranteed but requires an application, interview, and hiring process should a student be selected for a position by a department.

PLUS loan and Private loan applications should not be completed until after the student has been official awarded in late June. Once a student is officially awarded a student is able to determine any remaining amount needed to pay for their educational expenses for the upcoming academic year.

Fall semester bills are usually sent to students in July. For billing questions please contact the University Business Office.

Yes, the University Business Office does offer semester payment plans. For questions regarding payment plans please contact the University Business Office.