James Madison University is committed to using the Principles & Standards of the College Cost Transparency Initiative in its student financial aid offer.

James Madison University is committed to using the Principles & Standards of the College Cost Transparency Initiative in its student financial aid offer.

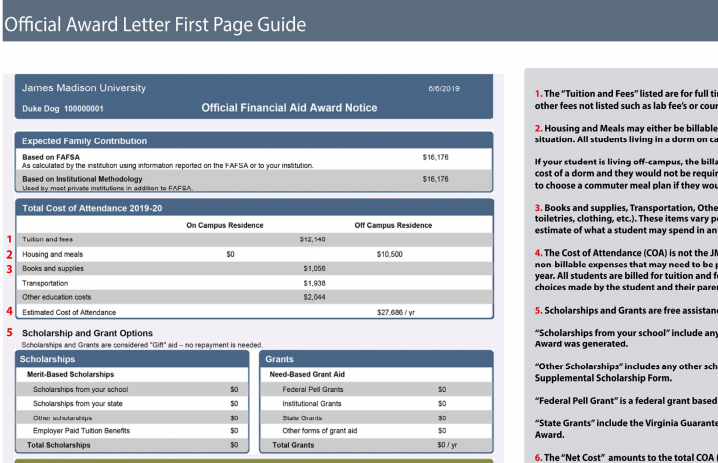

The Official Aid Offer will be available in MyMadison for students to view. Once a student’s offer has been generated, an e-mail will be sent to the student's JMU Dukes email, stating the offer is available to be viewed.

How to View Official Aid Offer

To view your Official Financial Aid Offer:

- Log into MyMadison

- Click on the "Student" tab

- Select the "Student Center"

- Click on the "View Official Award Notice" link in the "Financial Aid" section of the "Student Center", then select the Aid Year of the Offer that you would like to view. The PDF document will open in another tab. You must disable your pop-up blocker for this link to open.

MyMadison Instructions to View Offer

NOTE: You will be required to complete an "Aid Year Survey" the first time you access your offer.

Official Aid Offer Frequently Asked Questions

Jump to section

General Financial Aid

The first place we would suggest a student reviewing is the "Learn" section. We also recommend reviewing information contained in the JMU Terms and Conditions for Financial Aid – Consumer Information on our website. We keep the Announcements section of our main website updated with key information applicable to the current time of the year.

The most common reasons are:

- You have not submitted Free Application for Federal Student Aid (FAFSA) for the applicable aid year.

- You have outstanding items that need to be completed to finish the financial aid review process. This could be outstanding Verification items, the need to submit a Satisfactory Academic Progress (SAP) appeal, or other reasons.

While we will e-mail you at your JMU e-mail account when something is needed, we suggest checking your ToDo list in MyMadison as well. Many times, items needed will be posted to your ToDo list to notify you of their need for completion.

It’s also important to note that some reasons for not receiving an aid offer may not generate communication from us. For example, if you are not enrolled in a degree program, your FAFSA will not be reviewed to determine your aid eligibility.

Unfortunately, no. The FAFSA contains very specific rules on whether a student needs to include their parents on the application. At no point in the process is who claims whom on their taxes part of the consideration. While the decision of claiming students on their taxes, or not, has implications on taxes, it plays no role in determining financial aid eligibility.

Verification

Yes. Our office located on the 5th floor of the Student Success Center and will be open during normal business hours. Or, if you prefer, you may fax (540-568-7994) or mail your documentation to us. Please make sure that documents submitted are signed, especially any tax returns submitted, and include the student’s JMU ID. Our mailing address is:

James Madison University

Office of Financial Aid & Scholarships

Student Success Center

738 S. Mason Street, MSC 3519

Harrisonburg, VA 22807

Verification is a normal process that all colleges and universities are required to complete. There may be information on the FAFSA the Department of Education requires that we review, so we request documentation be submitted for our office to review.

Grants

In order to apply for any grants at JMU, you need to file your Free Application for Federal Student Aid (FAFSA) for the applicable aid year. This is the only application JMU uses in order to determine grant eligibility. For students that are Viriginia residents, a FAFSA would need to be filed by March 1st prior to the start of the new academic year to be eligible for state grants. Students can submit the FAFSA after this date, but funds could be limited when the priority filing date is missed.

The results of your FAFSA were used to determine your grant eligibility. If you did not receive a grant offer, then that means you did not qualify based on the awarding criteria used at JMU, or that you filed your FAFSA after the March 1st priority filing date.

You can learn more about this within our Financial Aid: Terms and Conditions.

Every public school in Virginia receives an allocation of state grant money, which includes VGAP. The allocation received by each school is not the same size, so you will see different award amounts from the various institutions. In fact, some schools receive two or three times more in their state grant allocation than JMU.

Outside of ensuring the students we offer these awards to meet some basic criteria mandated by Virginia, schools have flexibility in determining the amounts awarded to students at their institution. As a result, the awards will not be the same between all public institutions, and it’s even possible for one school to offer a grant to a particular student when another does not.

As a public institution, we are prohibited from using state grant dollars for out-of-state students. Therefore, the only grants available for out-of-state students are the Federal Pell Grant, and in some situations the Federal Supplemental Educational Opportunity Grant (FSEOG). The only application you need to file to be reviewed for these grants is the Free Application for Federal Student Aid (FAFSA).

Loans

Federal education loans are federally backed loans provided by the government for your student’s education. These consist of the Federal Subsidized Direct Loan, Federal Unsubsidized Direct Loan, and Federal Parent PLUS Direct Loan. To qualify for federal education loans, you must submit a FAFSA. Private loans are non-federal educational loans offered by private lenders (i.e. banks, credit unions) to assist with educational expenses. Because the federal government does not back them, private loans may have terms and conditions less favorable than federally-funded student and parent loans; take advantage of all your federal student aid opportunities before considering a private loan.

You can learn more about loan programs on Learn My Financial Aid Options section of our website, or by watching the brief “Student Loan” video in the Financial Aid Videos section of our website.

Please do not apply for a private educational loan for the fall/spring aid year earlier than June. If you submit an application prior to June, your credit may expire before the loan can disburse.

We suggest you review the private educational loan information before submitting an application with a lender.

JMU has compiled a list of preferred lenders for our student and parent borrowers to assist in the navigation and research of potential lenders. The preferred lender list and other guidance is found on the Private Loan section of our website.

We strongly encourage students to consider the Federal Direct Loan Program before applying for a private educational loan.

The Official Financial Aid Offer contains your Federal Subsidized Direct Loan, Federal Unsubsidized Direct Loan, and Federal Parent PLUS Direct Loan eligibility based on the FAFSA. The Parent PLUS does require a separate application that parent's can complete through studentaid.gov. Please do not submit applications until after you have received your aid offer.

All the instructions for how to complete the loan process will be included in the aid offer. Parent emails listed on the FAFSA will also receive an email with information regarding the Parent PLUS Loan.

Once you have been offered your Federal Subsidized Direct Loan and Federal Unsubsidized Direct Loan eligibility via your Official Financial Aid Offer, the loans may be accepted through your MyMadison account. If this is your first time borrowing, you will also need to submit a Subsidized/Unsubsidized Master Promissory Note as well as complete Entrance Loan Counseling via studentaid.gov. Parent PLUS Loan applications and Master Promissory Notes must be submitted by the parent borrower via www.studentaid.gov.

All of these steps will be outlined in your Official Financial Aid Offer. If you have further questions, please view the resources available on the Official Financial Aid Offer page.

All loans, except for a few private lenders, disburse loans directly to JMU. Once received, these funds are applied directly to your JMU bill to be applied to those charges first. Any funds in excess of the bill are then refunded to the loan borrower by the University Business Office.

You can read information created by the Department of Education about these loans at Comparing Federal Student/PLUS Loan versus Private Loans. Prior to applying for any loan, we encourage you to consider more than just the interest rate. For example:

- Private loans are often taken out by a student with someone (generally a parent) serving as the co-signer. That means the student and parent are both legally responsible for the loan, and it impacts both credit files.

- Parent PLUS loans are single borrower loans, meaning a single parent is responsible for the loan. The spouse and/or student has no responsibility for this loan, even if the borrower passes away. The same may not be true for private educational loans.

- The terms and conditions of private loans are created by each lender and are not federally mandated as they are Federal Direct Loans, nor do they contain any of the protections or benefits provided with federal loans.

Scholarships

Scholarship offers are sent to students from the department making the award, which may be a department outside of the Office of Financial Aid & Scholarships. With that said, students who are also receiving financial aid based on the FAFSA will be able to see the scholarship listed on that offer, provided we are aware of it at the time the Official Financial Aid Offer was generated.

Scholarship levels are generally determined based on the endowment size at the institution. While the JMU endowment has increased significantly over the past several years due to the generosity of our donors, there are many institutions with endowments larger than ours. This will impact the number of scholarships we have to award. Additionally, scholarships generally have very specific criteria, so it is possible for a student with lesser academic qualifications than another to receive a scholarship based on the criteria associated with the award.

Make sure you utilize the Madison Scholarships Hub to improve the possibility of receiving a scholarship.

JMU scholarship notifications typically come from individual university departments. The method of communication may vary. However, email is probably the most common method to ensure your earliest awareness.

To be eligible for need-based scholarships at JMU, you must file the Free Application for Federal Student Aid (FAFSA). The federal government uses this form to calculate an Student Aid Index (SAI), which is a measure of your family’s financial strength. The Office of Financial Aid and Scholarships subtracts your SAI from your cost of attendance (COA), which reflects the total amount it will cost you to go to college each year. The difference is your financial need. If you have any amount of financial need, you may qualify for need-based scholarships.

Selection criteria vary by scholarship and awarding department. However, the primary determinant for merit-based awards is exceptional academic performance. Other selection criteria may include leadership, involvement, geographical background, major field of study, and career goals.

A large percentage of outside scholarships come from churches, high schools, and organizations such as the Elks and Moose lodges. Also, large companies in your area or your parents' employers may be good resources. In some instances, you may not have to be directly associated with an organization to qualify for a scholarship. You can find some commonly used national search engines on the Outside Scholarships section of our website.

Receipt of scholarship funds from any source may reduce your eligibility for need-based state and federal financial aid. JMU is required by the Department of Education to include your private (or outside) scholarship when preparing your financial aid package. Therefore, you should submit a Outside Scholarship/Award Notification Form as soon as you are aware of your selection to receive one.

The answer is “yes”. However, the scholarships available will differ from those awarded to incoming freshmen and new transfer students. Your primary application tool will be the Madison Scholarships Hub, our scholarships management system. You can access Madison Scholarships Hub from your MyMadison account. Typically, the application in Madison Scholarships Hub opens in December-January for the following academic year (be sure to visit the website for specific dates). You would need to complete a new application for each academic year in order to be considered for scholarships.

Student Employment

On-campus jobs through the Work Study and Institutional Employment programs can be found through jobs.jmu.edu. Students looking for jobs should check this website frequently, as job postings can change frequently.

Having Work Study eligibility does not guarantee a student a job. Instead, having a Work Study offer gives you the ability to apply for Work Study jobs through jobs.jmu.edu.

Work Study wages are not credited to your student account. Instead, Work Study wages will be paid to you via direct deposit through JMU Payroll Services, and are based on the number of hours you work in that pay period. You are limited to earning no more in total Work Study wages during the school year than what you see on your Financial Aid Offer.

Yes, as a student carrying at least a half-time course load (6 credit hours) at JMU, you are eligible to work as an Institutional Employment student employee. While you are not required or limited to only Work Study jobs, we encourage Work Study eligible students to look at Work Study positions before applying for Institutional Employment positions due the benefits of being employed through Work Study.

Wages earned through a Work Study position are not counted as income when you file your FAFSA for the next school year. While they are taxable if you file income taxes, the FAFSA removes them so they do not count against your next year’s financial aid eligibility. That means you can earn wages this year that will not reduce your aid next year.

Contacts

If you would like to e-mail us any questions you have, please do so at the appropriate e-mail address below:

- Scholarships – scholarships@jmu.edu

- Special Circumstances – finaid_pj@jmu.edu

- Loans – loans@jmu.edu

- Verification – verification@jmu.edu

- General Financial Aid – fin_aid@jmu.edu