Section I - Check Date

This section gives you the pay period in which you are receiving payment. It contains your name, net pay, pay begin date, pay end date and check date. The check date that is listed in this section is the date of the payday. This is the bank business date your money will be deposited to your account if you are receiving a direct deposit. Banks deposit at different times based on their procedures. However, the date listed here is the date the money is made available to your banking institution.

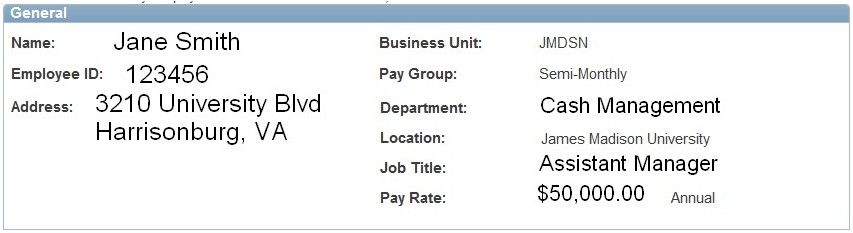

Section II - General

This section contains the information about you - your name and current address on file.

Additionally, this section contains information about your current job here at James Madison University. You will find your PeopleSoft employee ID number, the department who's budget is paying your wages, your job title, pay rate, and the pay group in which you are paid.

There are four pay groups of JMU employees:

- HR1: Employees paid by the hour

- SM1: Employees paid on a salary basis

- NRA: Non Resident Scholarship Recipients

- URT: University Retirement Plan

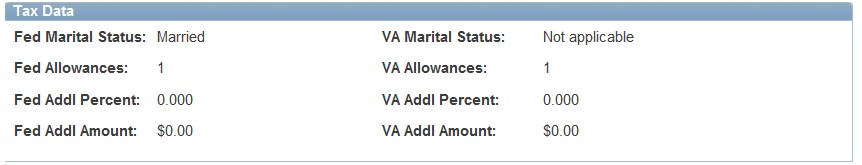

Section III - Tax Data

This section details your current tax filing status for both federal taxes and state taxes. Included is the marital status you claimed on your W-4 or VA-4 as well as the number of allowances you have claimed.

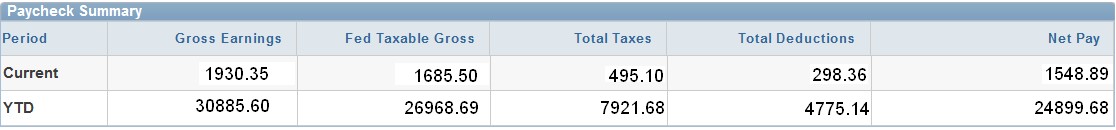

Section IV - Paycheck Summary

This section is a summary section of all the details listed below it. It includes the total gross wages you earned, the total taxable gross wages you earned, the total taxes withheld, the total deductions taken and your net pay.

The Federal Taxable Gross is calculated by taking your total gross wages less any before tax deductions and adding the taxable imputed life (see employer paid benefits).

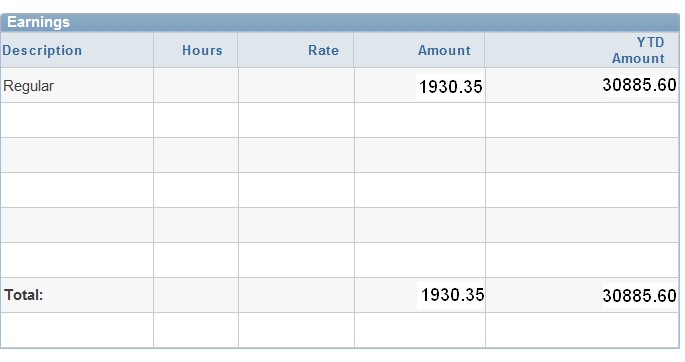

Section V - Earnings

This section gives you the description of what you are being paid for and what the amount is that you are receiving in GROSS pay. There are two columns in this section - one for current pay and one for year to date. If you are being paid hourly, the amount of hours in which you are receiving pay for is also listed in this section.

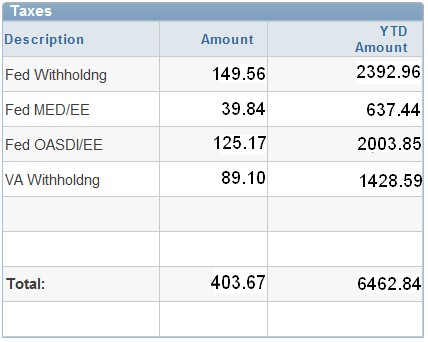

Section VI - Taxes

- Fed MED/ER and Fed OASDI/ER are the employer's share of FICA.

This section gives you a complete break-down of what taxes were withheld from your gross pay. You can see the total amount by current pay period or year to date.

Explanation of Acronyms:

- Fed Withholding: Federal Income Tax Withholding

- Fed MED/EE: Federal Medicare Tax (FICA/Social Security); Employee's Share; 1.45% of gross wages. Wages paid in excess of $200,000 effective 2013 will be subject to an extra .9% Medicare tax.

- Fed OASDI/EE: Federal Old Age Security & Disability Insurance (FICA/Social Security), Employee's Share, calculated on the first $168,600 ($160,200 in 2023) of wages earned by an employee during the calendar year, 6.2% of gross wages.

- VA Withholding: Virginia Income Tax Withholding

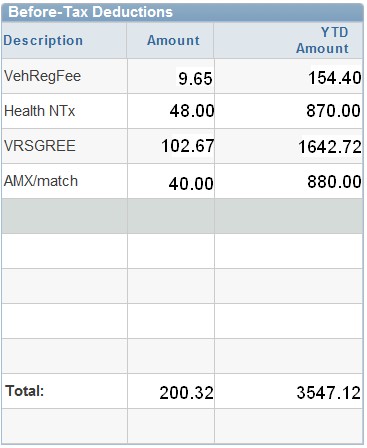

Section VII - Before Tax Deductions

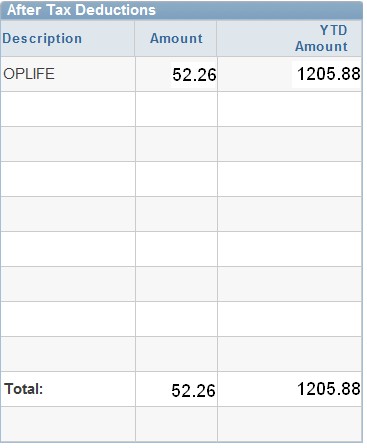

Section VIII - After Tax Deductions

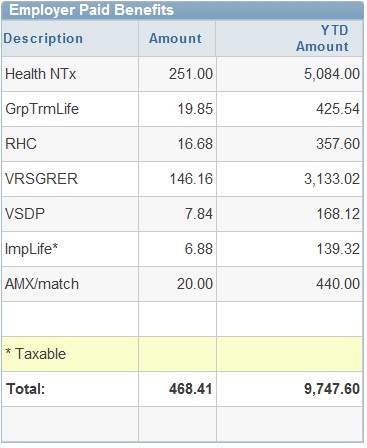

Section IX - Employer Paid Benefits

This section is an itemized listing of the costs of all benefits that your employer, James Madison University, pays for you as an classified employee. These costs, with the exception of imputed life, have no effect on your net pay. They are provided here for informational use only so that you can see the dollar amount of the employer provided benefits you receive if you are an eligible employee. If you are not eligible for benefits from JMU, this section will be blank.

The following is a listing of employer provided benefits acronyms and their descriptions:

| Employer Provided Benefits Code | Description |

| Health NTx | Portion of Health Insurance Premiums paid by the University for the Health Insurance Plan selected by the employee |

| GrpTrmLife | Group Term Life Premium paid by the University on behalf of the employee |

| ORP Retire GRORPRET (hired pr. 7/1/10) |

Optional Retirement Plan Contribution paid by the University for qualified faculty who so choose an optional retirement plan. |

| RHC | Retiree's Health Care Premium paid by the University on behalf of the employee |

|

VRS Retire Hybrid DB, VOL & Man (hired after 1/1/14) |

Virginia Retirement System Contribution paid by the University on behalf of the employee for all classified staff, as well as faculty members who choose VRS for their retirement plan. |

| ImpLife | Imputed Life; Amount of Taxable Benefit for Group Life Insurance Coverage over $50,000.00 provided by the University. This amount is added to your Federal Taxable Gross per pay period, as it is a taxable benefit to the employee per IRS Tax Regulations. |

| VSDP | Contributions made to the Virginia Sickness and Disability Program on behalf of all JMU employees who are a participant of the VRS Retirement System. |

| Fed MED/ER | Employer's share of the medicare portion for social security, this matches the employees share of the same type of tax (.0145 of gross wages). |

| Fed OASDI/ER | Employer's share of the old age portion for social security, this matches the employee's share of the same type of tax (.062 of gross wages up to $168,600 annually). |

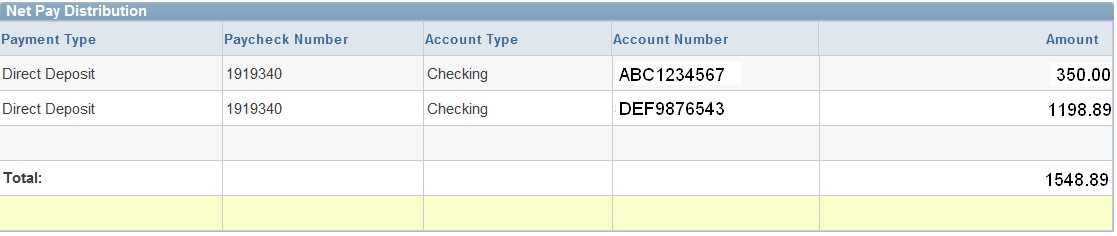

Section X - Net Pay Distribution

This section details the account numbers and account types of your direct deposit. It lists the amount of money deposited to each account.