The One Big Beautiful Bill Act (H.R.1), signed into law by President Trump on July 4, 2025. For students, families, and institutions like JMU, this bill is significant because it changes some rules related to the federal aid (Title IV) programs.

As of the development of this webpage, these changes are scheduled to go into effect July 1, 2026, and/or with the 2026-27 Free Application for Federal Student.

Current Rules Before 2026-27

- Full-Time Academic Year Definition: to be considered full-time for the academic year

- Undergraduate students: Must take 24 credit hours over the course of the fall and spring terms.

- Graduate/Professional/Doctoral students: Must take 18 credits over the course of the fall and spring terms.

- Half-time Enrollment: Students must be enrolled at least in a half-time load of financial aid-eligible classes to receive a Federal Direct Loan in any given semester. The minimum number of credits per semester to be considered half-time is:

- Undergraduates: 6 credit hours

- Graduate/Professional/Doctoral students: 5 credit hours

- Loan Amount: A student can receive the full annual Federal Direct Loan amount as long as their financial aid eligibility allows them to do so.

- Award Calculation: Cost of Attendance (COA) – Gift Aid (grants/scholarships) – Federal Work Study = Remaining eligibility for loans

Example Student Award Offer:

Full-time Cost of Attendance (COA): $35,142Grants: $7,395

Scholarships: $10,000

Federal Work Study: $4,300

Remaining Eligibility: $13,447

This student has $13,447 of eligibility remaining before reaching the full Cost of Attendance.

Congress set the maximum annual Federal Direct Loan limit based on a student’s grade level.

For this example, the student is a Dependent Junior with a maximum annual limit of $7,500. Since the student has $13,447 in remaining eligibility, they can receive the full $7,500 in a Direct Loan. Factors such as the Student Aid Index (SAI) will determine how much of the loan is subsidized versus unsubsidized, but the overall amount is capped at $7,500 per year.

If the student dropped from a full-time (12+ credit hours) load of financial aid eligible classes in the fall to three-quarter time (9-11 credit hours), the student could still keep the entire $7,500 as long as the adjusted COA would leave enough remaining eligibility to do so. In most cases, it would.

Changes Effective in 2026-27

- Full-Time Academic Year Definition: to be considered full-time for the academic year

- Undergraduate students: Must take 24 credit hours over the course of the fall and spring terms.

- Graduate/Professional/Doctoral students: Must take 18 credits over the course of the fall and spring terms.

- Half-time Enrollment (No change from the current rules): Students must be enrolled for at least a half-time load of financial aid-eligible classes to receive a Federal Direct Loan in any given semester. The minimum number of credits per semester to be considered half-time is:

- Undergraduates: 6 credit hours

- Graduate/Professional/Doctoral students: 5 credit hours

- Less than Full-Time Enrollment: Starting with the 2026–27 award year, Direct Loan amounts for students who are not full-time for the full academic year will need to be adjusted. We are waiting for guidance from the Department of Education on the formula for making these adjustments in all scenarios. What we have received to date indicates that less than full-time enrollment in one semester may affect loan eligibility in another, rather than just the semester in which it occurred, but the Department of Education's examples are not comprehensive enough to fully outline how this will work in every enrollment scenario. For example, we have no guidance as to how this will work for enrollment in the summer semester.

- Award Calculation: Cost of Attendance (COA) – Gift Aid (grants/scholarships) – Federal Work Study = Remaining eligibility for loans.

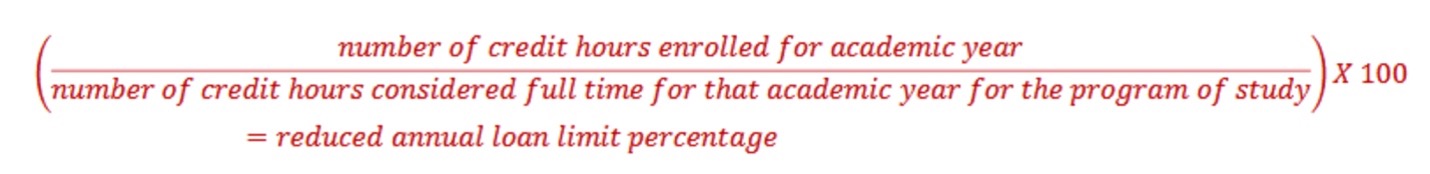

- Less than full-time formula for loan eligiblity:

This adjustment rule applies to all undergraduate, graduate, and professional student Direct Loan borrowers, utilizing Direct Subsidized Loans, Direct Unsubsidized Loans, and/or Graduate PLUS Loans. Even those considered legacy borrowers who have borrowed from any of these loan programs prior to July 1, 2026 are subject to this rule.

Since this rule only impacts student borrowing, the Federal Direct Parent PLUS Loan is not subject to these adjustments for less-than-full-time study.

Example Student Award Offer:

Let’s say you’re a Dependent Junior who can borrow up to $7,500 in student loans for the school year. You plan to take 12 credit hours in the fall and 12 credit hours in the spring, which makes you a full‑time student (full‑time = at least 12 credits each term).

That means:

- Full-time for the year = 24 credits (12 fall + 12 spring)

- Your loan normally comes in two equal payments:

- Fall: $3,750

- Spring: $3,750

What Happens When You Drop a Class

If you drop from 12 credits to 9 credits in the fall AFTER your loan is already disbursed the fall loan does not have to be reduced.

Before giving you the spring portion of the loan, JMU must verify how many credits you are actually going to finish for the combined fall and spring terms.

Your New Plan for the Year

- Fall: 9 credits

- Spring (expected): 12 credits

- Total: 21 credits

Originally, full‑time for the year was 24 credits, but now you’ll only have 21 credits.

Percent of Full-Time You’re Completing

(21

This means you are scheduled to complete 87.5% of the credits needed to be considered full‑time for the combined fall and spring terms.

How This Affects Your Loan

Since you’re only completing 87.5% of the needed credits, you can only receive 87.5% of your $7,500 loan limit:

You already received $3,750 in the fall.

So for spring, you can only receive:

Even if you take 12 credits in the spring, your spring loan is limited to $3,063 because your total enrollment for the year dropped.

How You Could Still Get the Full Spring Loan

If you take 15 credits in the spring, then your total for the year becomes:

- Fall: 9

- Spring: 15

- Total: 24 credits

Now you’re back to completing a full‑time year.

That means you can get the full $3,750 for spring.

The Department of Education has not published final rules for implementing the One Big Beautiful Bill Act. As a result, answers to the FAQ’s are based on our current understanding of the law and outcomes of the Negotiated Rulemaking process. They may change when the final rules are released. A date has not been published for when final rules will be available. It is anticipated that this will occur in late winter or early spring.

Undergraduate – A minimum of 12 financial aid-eligible credit hours per term is considered full-time, which means 24 hours over the course of the fall and spring term is needed to be considered full-time during the academic year.

Graduate/Professional/Doctoral - A minimum of 9 financial aid-eligible credit hours per term is considered full-time, which means 18 hours over the fall and spring terms are needed to be considered full-time during the academic year.

Summer Enrollment – 12 financial aid-eligible credit hours for undergraduates and 9 for graduate/professional/doctoral students are needed to be considered full-time. As of the writing of this question, we have yet to receive guidance from the Department of Education on how to adjust loans for summer enrollment below full-time.

As of the writing of this question, we have yet to receive guidance from the Department of Education on how to adjust loans for summer enrollment below full-time. The only example we have received outlines one particular scenario in the fall and spring terms.

We anticipate receiving additional information once the Department of Education posts Final Rules, which may occur in late winter or early spring.

If you are an undergraduate enrolled for 12 financial aid-eligible credit hours in the fall term and reduce your schedule to less than full-time before your fall loan is disbursed, JMU will have to reduce your fall loan based on the new rules.

If you are enrolled for 12 financial aid-eligible credit hours in the fall term and reduce your schedule to less than full-time after your fall loan is disbursed, you may be able to keep the full fall loan disbursement, but your spring loan disbursement may be reduced if you are only taking 12 hours in the spring.

However, if you take enough hours in the spring so that the total of your fall and spring hours equals at least 24, you may be able to keep the full spring loan disbursement as well.

The same rules apply to graduate/professional/doctoral students, but the financial aid-eligible hours are based on 9 in the fall and spring terms and 18 between the two.

Students who are less than full-time often have a Cost of Attendance that is lower than that of full-time students. A reduced Cost of Attendance can impact Parent PLUS Loan eligibility. The new rules and legacy rules for Parent PLUS Loan eligibility can be viewed on our website.

With that backdrop. Parent PLUS Loans are not reduced the same way as Direct Subsidized Loans, Direct Unsubsidized Loans, and Graduate PLUS Loans for less than full-time enrollment.

According to information from the RISE Negotiated Rulemaking Committee, loan reductions for less than full-time enrollment are calculated based on the academic year minimum, not the term. Undergraduate students who complete 24 financial aid-eligible credit hours between the fall and spring terms are considered full-time for the academic year.

Under normal circumstances, students in this situation would complete 12 credit hours in the fall and 12 in the spring. However, if a student completes only 9 in the fall (dropping from 12 to 9 after the fall loan is disbursed), that puts the student on pace to complete only 21 of the 24 hours between the fall and spring. In this case, the spring loan will be reduced because the student will not complete 24 credits.

However, in this scenario, if the student takes 15 hours in the spring, they will have completed the required 24 hours and can receive the full spring loan.

As of the writing of this question, we have yet to receive guidance from the Department of Education on how enrollment in the summer term will factor into this. The only example we have received outlines one particular scenario in the fall and spring terms.

Effective July 1, 2026, the Grad PLUS Loan will be available only to legacy borrowers. For those borrowers, eligibility is calculated based on the formula of:

Cost of Attendance – Other Financial Aid = Grad PLUS Loan eligibility

Unlike the fixed caps on subsidized and unsubsidized loan limits, Grad PLUS Loan eligibility can vary by student. However, Grad PLUS Loans will be reduced for less than full-time enrollment, as they are considered “student” Direct Loans. Since an unsubsidized loan has a programmatic annual maximum limit, but the Grad PLUS annual maximum amount can vary by student, we need guidance from the Department of Education on how to calculate eligibility for less than full-time enrollment for this program.

The One Big Beautiful Bill Act introduces significant changes to federal student aid programs, and while some provisions are clear, many others require further clarification from the U.S. Department of Education.

We understand that students, families, and staff have questions—and so do we.

As we receive more guidance and official updates, we will continue to revise and expand this webpage to reflect the most accurate and actionable information available.