Parent PLUS Loans are for parents of dependent undergraduate students.

The One Big Beautiful Bill Act (H.R.1), signed into law by President Trump on July 4, 2025. For students, families, and institutions like JMU, this bill is significant because it changes some rules related to the federal aid (Title IV) programs. Some of those changes impact Federal Direct Parent PLUS Loans available to undergraduate students.

As of the development of this webpage, these changes are scheduled to go into effect July 1, 2026, and/or with the 2026-27 Free Application for Federal Student.

Current Limits (before July 1st, 2026)

- Annual Limit: Determined by the formula of “Cost of Attendance – Other Aid (i.e. grants, scholarships, other loans)”

- Aggregate Limit: No limit

- Eligibility is based on student enrollment and a minimal credit check of the parent applicant

Changes Effective July 1st, 2026

- Annual Limit: $20,000 per student (combined from all parents)

- Aggregate Limit: $65,000 per student

- Legacy Provision: Students with any existing Direct Loan may continue borrowing for up to 3 years or until program completion, whichever is less.

- New Borrowers: Must seek alternative funding if limits are exceeded

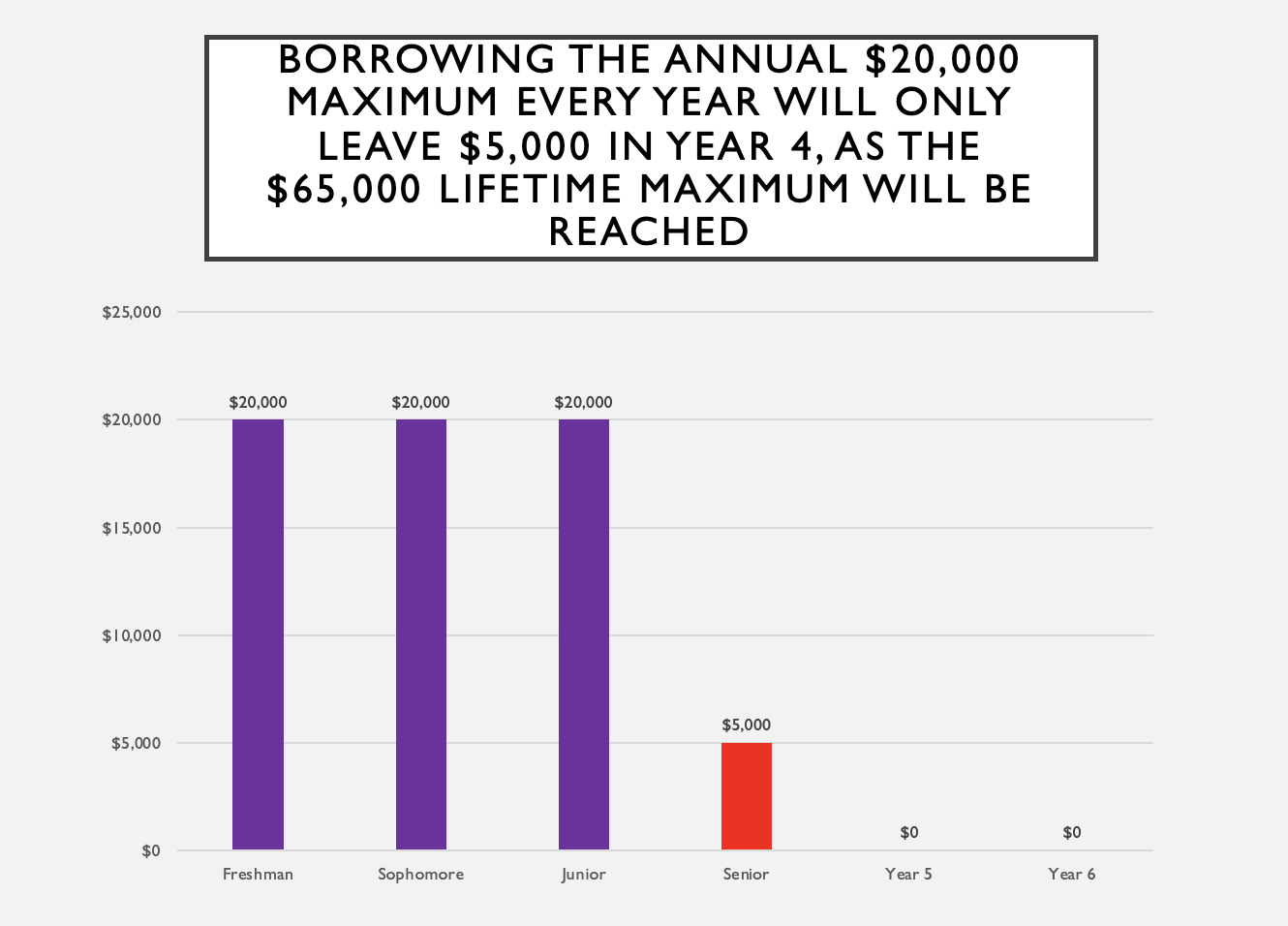

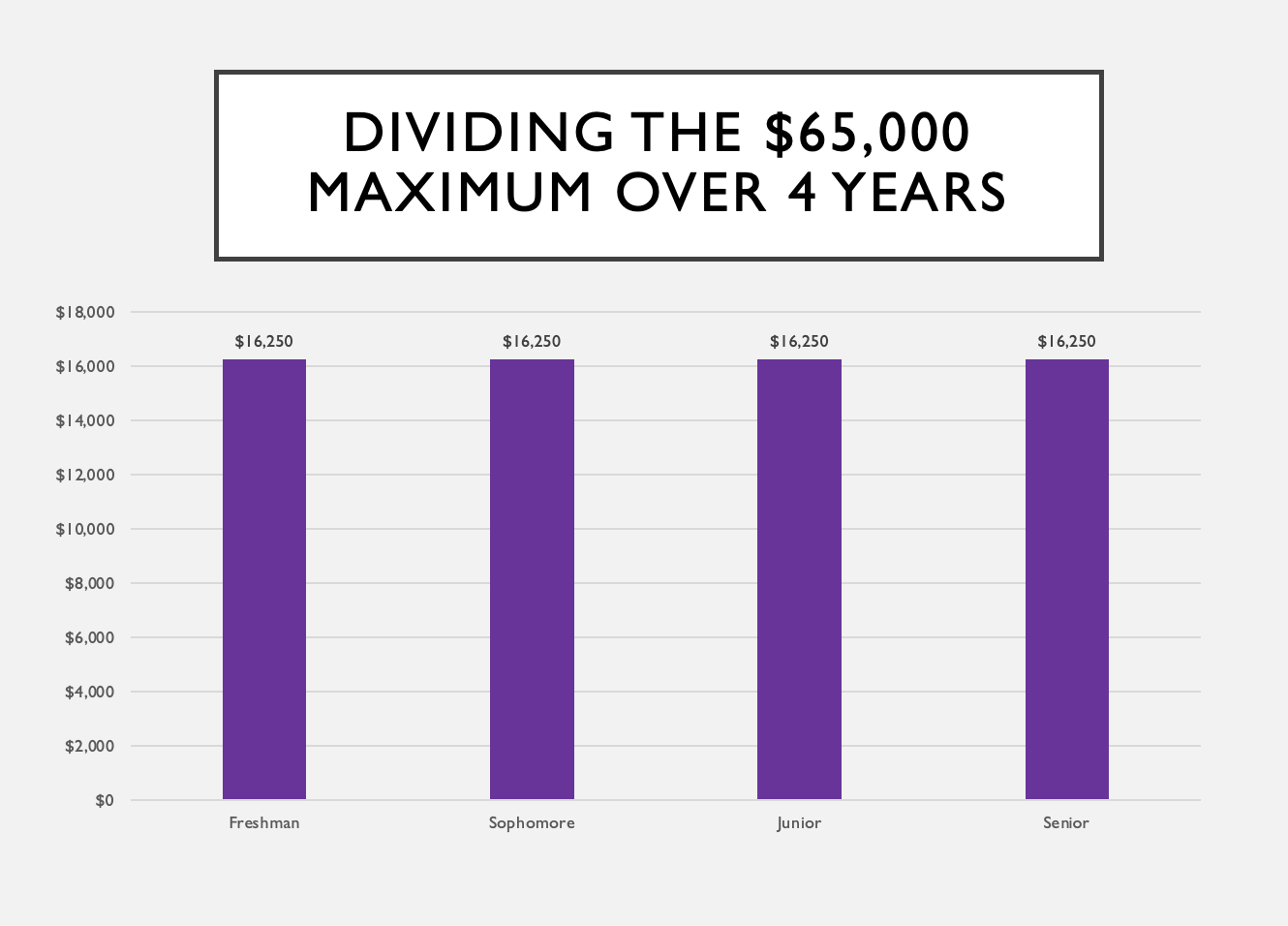

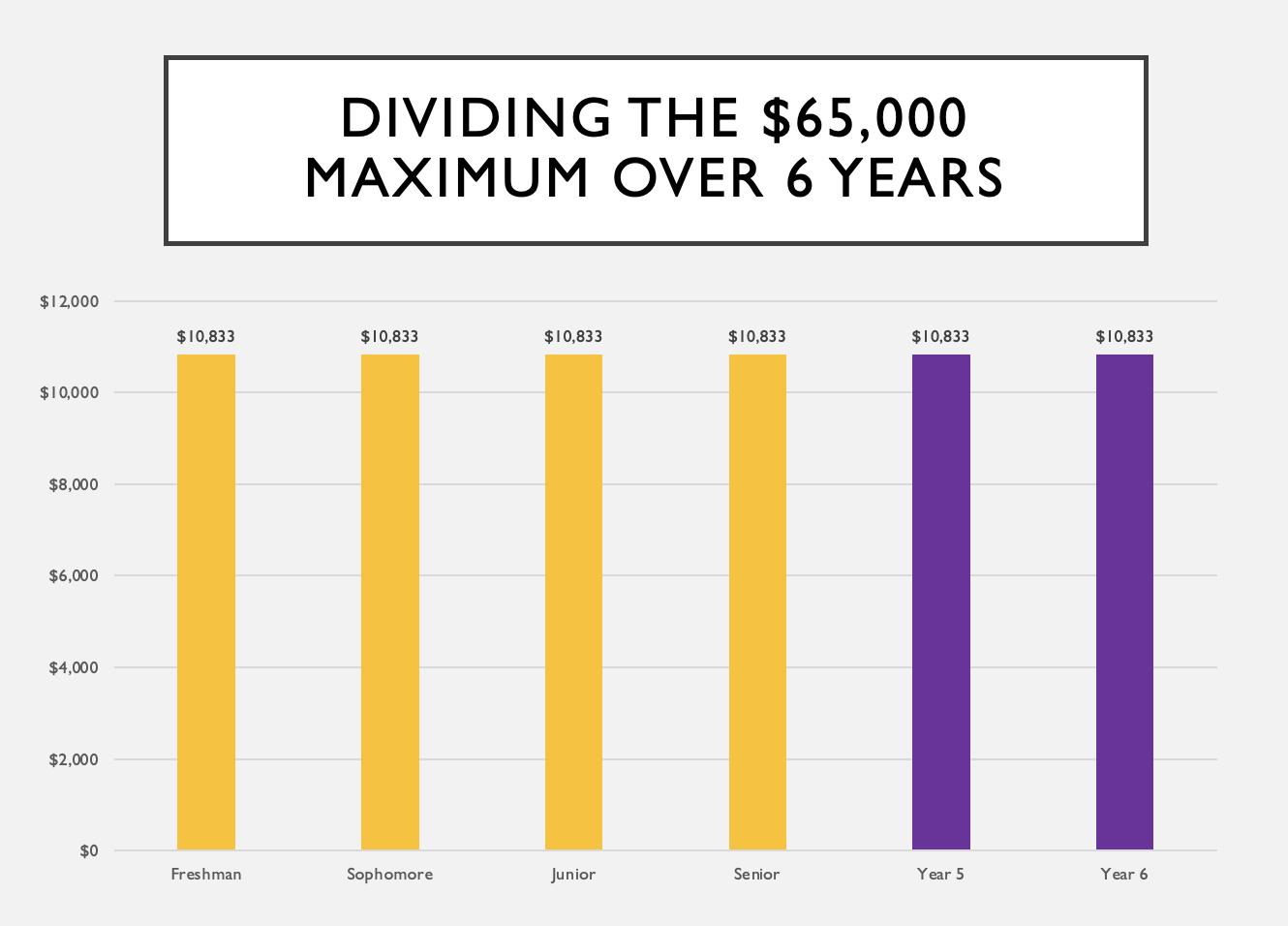

**review the images below to see a break down of the limits over four to six years

Institutional Discretion

Schools may have the ability to set lower annual loan limits by program. Limits must apply uniformly to all students in the program.

Planning Ahead

For families that need funding outside of the new limits the options below can be pursued.

Alternative funding options can include:

- Private loans

- Payment plans

- Scholarships

- Home equity or personal loans

The Department of Education has not published final rules for implementing the One Big Beautiful Bill Act. As a result, answers to the FAQ’s are based on our current understanding of the law and outcomes of the Negotiated Rulemaking process. They may change when the final rules are released.

A date has not been published for when final rules will be available. It is anticipated that this will occur in late winter or early spring.

Legacy Borrowers

Effective July 1, 2026, the One Big Beautiful Bill Act changed many of the rules for the new borrowers of the Federal Parent PLUS Direct Loan. To continue borrowing under the current rules, you must be considered a legacy borrower.

Legacy borrowers may continue using this loan program for 3 years or until the student completes their program, whichever is shorter.

A legacy borrower is a parent of a current JMU student who has borrowed any Federal Direct Loan (i.e., Subsidized, Unsubsidized, or Parent PLUS) before July 1, 2026. Borrowing a loan before July 1, 2026, means the loan was disbursed before that date.

Parents are considered legacy borrowers if:

- Their student has previously borrowed a Subsidized or Unsubsidized Direct Loan at JMU, even if the parent has never borrowed from the Federal Parent PLUS Direct Loan program.

- They have borrowed from the Federal Parent PLUS Direct Loan before July 1, 2026.

Yes. There are a few ways these borrowers can lose eligibility.

Continuous Enrollment Requirement

The student of a legacy borrower for the Parent PLUS Direct Loan must be continuously enrolled. For example, legacy borrowers will lose eligibility to continue using the Parent PLUS Direct Loan under the pre-July 1, 2026 rules if their:

- Student takes a fall or spring semester off

- Student begins enrollment in a fall or spring semester and withdraws partially through it

Summer is excluded from the continuous enrollment requirement, so a borrower will not lose eligibility for not taking classes in the summer.

Three Years of Eligibility

Legacy borrowers can only retain eligibility for the Parent PLUS Direct Loan for 3 years after July 1, 2026, or the remainder of their student’s program of study, whichever is shorter.

Changing Programs

Legacy borrowers will NOT lose eligibility if their student changes majors to a different undergraduate program after July 1, 2026. However, changing majors may extend the student’s time to complete their degree, exceeding the 3-year maximum allowed for legacy status. If that occurs, parents may lose access to the Federal Parent PLUS Direct Loan program under the pre-July 1, 2026, rules before the student graduates.

Students of legacy borrowers must be continuously enrolled. For example, legacy borrowers will lose eligibility to continue using the Federal Parent PLUS Direct Loan program under the pre-July 1, 2026 rules if their student:

- Takes a fall or spring semester off

- Begins enrollment in a fall or spring semester and withdraws partially through it

Summer is excluded from the continuous enrollment requirement, so a borrower will not lose eligibility for not taking classes in the summer.

Our understanding is that a “year” is an academic year, not a calendar year.

No. Legacy borrower rules require enrollment in the same degree program at the same institution. If he begins enrollment at JMU in a new degree program after July 1, 2026, you will not qualify as a legacy borrower to continue using the Parent PLUS Direct Loans under the pre-July 1, 2026 rules.

New Borrowers

Effective July 1, 2026, the One Big Beautiful Bill Act changed the annual and aggregate limits for the Federal Parent PLUS Direct Loan program. Even though this is a parent loan and the student has no legal responsibility to repay it, the annual and aggregate limits are based on a student’s eligibility, not the parents.

- Students may receive no more than $20,000 in an award year, which is the summer, fall, and spring terms at JMU (in that order).

- Students may receive no more than $65,000 in total (aggregate) during the time they are pursuing their undergraduate degree.

No. You do not meet the definition of a “legacy borrower.” Refer to the Legacy Borrower FAQ’s for more information about those requirements.

No. Congress set the limit based on the student, not the parent borrower. A student can have no more than $20,000 per year in Federal Parent PLUS Direct Loan.

We strongly encourage students to be on a track to graduate in four years or less. Most undergraduate degree programs require a minimum of 120 credit hours to complete. A student must average at least 15 credit hours a semester to accumulate 120 credits in four years. Encouraging your students to be on pace for a four-year degree will reduce the need to borrow.

Even with that, you will only have $5,000 remaining in year four if you borrowed $20,000 each of the prior three years. The options are:

-

-

- Borrow less than $20,000 per year for the prior three years, as there is no requirement to borrow the full amount each year.

-

- Review your personal budget and sign up for the Installment Payment Plan

- Seek private/alternative loans, but there is no guarantee of approval from those sources

Lastly, in the college selection process, we encourage students to calculate the total cost of attendance and determine if JMU is an affordable option for them. We recommend borrowing as little as possible or not borrowing at all if that is an option, to secure their college degree.

If you know JMU is unaffordable without receiving $20,000 per year from the Federal Parent PLUS Direct Loan, then it may be prudent to consider other college options. Staff in The Office of Financial Aid & Scholarships are available to discuss this with you, as we realize selecting a college is a significant commitment.

-

The One Big Beautiful Bill Act introduces significant changes to federal student aid programs, and while some provisions are clear, many others require further clarification from the U.S. Department of Education.

We understand that students, families, and staff have questions—and so do we.

As we receive more guidance and official updates, we will continue to revise and expand this webpage to reflect the most accurate and actionable information available.