Qualifying for In-State Tuition

James Madison University is a public university within the Commonwealth of Virginia. As such, we go by the State Council of Higher Education for Virginia Domicile Guidelines to determine eligibility for in-state tuition. Re-entry applicants have their residency for tuition purposes determined based on the information provided in the "Application for Virginia In-State Tuition Rates" section of the Undergraduate Re-entry Form. Once the Undergraduate Re-entry Form is submitted you may be requested to provide additional documentation to determine your residency for tuition purposes. Academic Student Services will notify you of your residency determination in the communication you will receive concerning your re-entry status.

Please understand we cannot advise a student before applying whether or not they will qualify for in-state tuition.

You may review the Commonwealth of Virginia’s Guidelines for Residency Determination by visiting the SCHEV guidelines website.

Yes. It has been, at minimum, two (2) years since you were last enrolled at JMU, so we need to (re-)assess your tuition status.

The State Council of Higher Education for Virginia has published helpful guides to the rules we go by to determine eligibility for in-state tuition for active-duty military members, veterans, and their families, located on the SCHEV website.

For more information about Veteran’s educational benefits, please visit the JMU Veteran’s Educational Benefits web page.

Applying for Residency

If you are requesting Virginia In-State Tuition Rates, you will need to complete the Application for Virginia In-State Tuition Rates section of the re-entry application, and provide specified residency application documentation. Failure to complete the residency section of the re-entry application will result in an out-of-state residency classification.

The Virginia In-State Tuition Rates section of the re-entry application has 4 sections:

- Section A

- Completed by the applicant seeking Virginia In-State Tuition Rates.

- Section B

- Completed by the parent(s)/guardian(s) if the applicant is under the age of 24 and is not married and/or if the applicant was claimed as a dependent for federal income tax purposes.

- Section C

- PDF copies of the most recent year’s federal and state tax forms – with financial information and social security number(s) blacked out - for the applicant and the applicant's parent(s)/guardian(s)/spouse (if applicable) must be uploaded in Section C. Income tax returns must be dated and signed. A photocopy of a current Immigration Visa must be submitted if applicable. The applicant may also submit any additional documents to support entitlement to Virginia instate tuition in Section C.

- Section D

- Applicant will certify that the information shared and uploaded in the Application for Virginia In-State Tuition Rates section of the re-entry form is accurate.

Residency Documentation

There are a number of different reasons why you may have received this request. You may not have submitted the proper form(s) (for example, you may have submitted a copy of your W-2 instead of a copy of your 1040 federal income tax form, etc) for the proper year (for example, you may have submitted tax forms from four years ago instead of the tax form from the most recent year) or additional information/documentation may be needed in order to make a final determination concerning your tuition status.

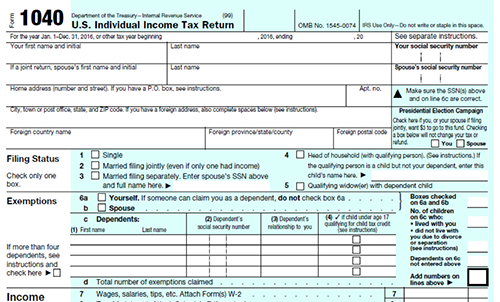

- Federal Income Tax Form (Federal 1040)

Send the first two pages (with social security numbers, bank account numbers removed/redacted).

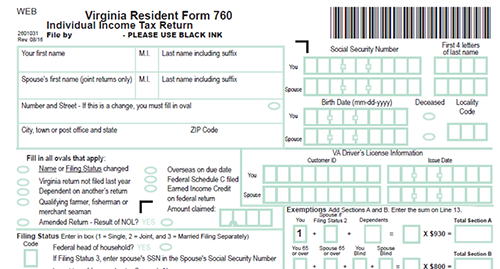

- Virgina State Income Tax Form (State 760)

Send the first two pages (with social security numbers, bank account numbers removed/redacted).

Do NOT provide the following:

- W-2

- e-file certificate

- Tax return transcript

Residency Decisions

Academic Student Services will notify you of your residency determination in the communication you receive concerning your re-entry status.

You may appeal your residency decision. Please note that in-state tuition is not need-based. We follow the State Council of Higher Education for Virginia's Domicile Guidelines. You may appeal your status in writing to the Vice Provost for Student Academic Success. Residence status may be changed after enrollment and for succeeding semesters through University Business Office.