October is National Retirement Security Month (NRSM)

National Retirement Security Month is a national effort to raise public awareness about the importance of saving for retirement. NRSM provides an opportunity for employees to revisit their personal retirement goals and determine if they are on track for a secure future.

According to Retirement Insecurity 2024, a recent report on American's view of Retirement, "finds that working age Americans are increasingly worried about retirement " and " eighty-three percent of respondents say that all workers should have a pension so they can be independent and self-reliant in retirement." Therefore, making the time to consider plans for the future is a must for everyone.

Tune in throughout the month for information and access to resources that can help you confidently plan for your future.

Ways You Can Take Action

- VRS Plan 1, 2 & Hybrid Members: Log into your myVRS account and review your 2025 Member Benefit Profile

- Attend one of the many financial seminars during Money Matters on 10/22 (Registration Required)

- Benefit eligible employees can start saving more today by enrolling in a Supplemental Retirement Plan, and earn the Cash Match

Participation in either of the following, earns you the Employer-Paid Cash Match

- Attend a variety of educational webinars:

- 'Are You on Track' - This presentation for current VRS Plan 1 and Plan 2 members and will get you up to speed on your VRS membership and the importance of planning now for your future. Topics include an overview of your VRS benefits and optional programs, why you may want to purchase prior service and member account resources, such as myVRS. Presented by a VRS Member Education and Outreach Counselor

- 10/6/2025 2 p.m.-3 p.m.

- 12/11/2025 9:30 a.m.-10:30 a.m.

Click HERE to REGISTER

- ‘Retirement Income’ – This presentation is about discovering how you can plan ahead to help you have income when you retire b calculating monthly expenses, identifying gaps and exploring your incomes in retirement.

Presented by VOYA- 10/14/25 10am-10:30 a.m. or 2:00 p.m.-2:30 p.m.10/28/25 12 p.m.-12:30 p.m or 3:00 p.m.-3:30 p.m.

Click HERE to REGISTER

- 10/14/25 10am-10:30 a.m. or 2:00 p.m.-2:30 p.m.10/28/25 12 p.m.-12:30 p.m or 3:00 p.m.-3:30 p.m.

- 'Are You on Track' - This presentation for current VRS Plan 1 and Plan 2 members and will get you up to speed on your VRS membership and the importance of planning now for your future. Topics include an overview of your VRS benefits and optional programs, why you may want to purchase prior service and member account resources, such as myVRS. Presented by a VRS Member Education and Outreach Counselor

Explore a variety of financial wellness and educational tools including: articles, videos, calculators live webinars and resources with myVRS Financial Welnness portal. You can explore general information or log int to your myVRS account and explore personalized content!

Financial Counseling is Available

See below for counseling options available and choose what works best for you!

- Employees may be eligible for a free 30 minute consultation with a CFP Professional. Schedule your meeting today!

- To meet with a Fidelity Advisor online or via phone 10/31, schedule your appointment.

- To meet with a Voya Representative virtually, schedule your appointment.

- To meet with a TIAA Representative on October 10/21, schedule your appointment.

- To meet with a Corebridge Financial (VALIC) Representative on 10/6, contact Jeffrey Gruse at 540-240-3317.

Experts recommend contributing at least 10% of your current income to your future retirement. Check your current 457 contribution amount DCP account login link or look at your paystub in MyMadison to see your current 403(b) contribution.

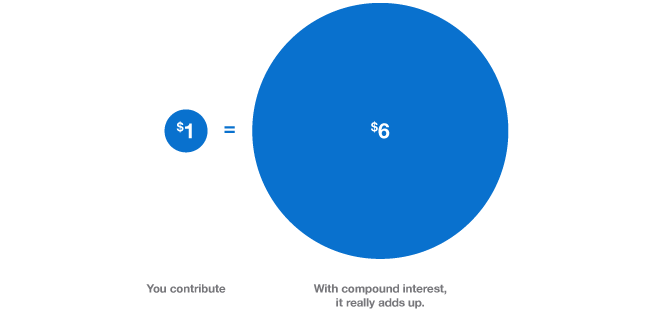

This illustration is a hypothetical compounding example that assumes biweekly salary deferrals (for 30 years) at a 6% annual effective rate of return. It illustrates the principle of time and compounding. This chart is for illustrative purposes only and is not intended to represent the performance of any specific investment. Actual returns will vary and principal value will fluctuate. Taxes are due when money is withdrawn.

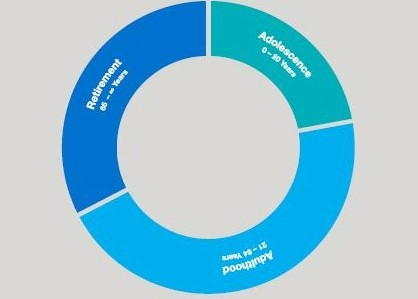

How long are you going to live in retirement?

Imagine that your retired life lasts as long as your working life. It could happen, and saving a little more now will make a big difference then.

Your VRS pension income or Optional Retirement Plan (ORP) income and Social Security can take you pretty far on your journey to a secure retirement, but contributing to an employer sponsored savings plan, such as a 457 or 403(b) can help make your retirement income picture complete.

Join fellow co-workers by participating in a Supplemental Retirement Plan. If you are already participating, check your contribution level to make sure you are on track. For more information visit the HR Benefits Supplemental Retirement Plans page.